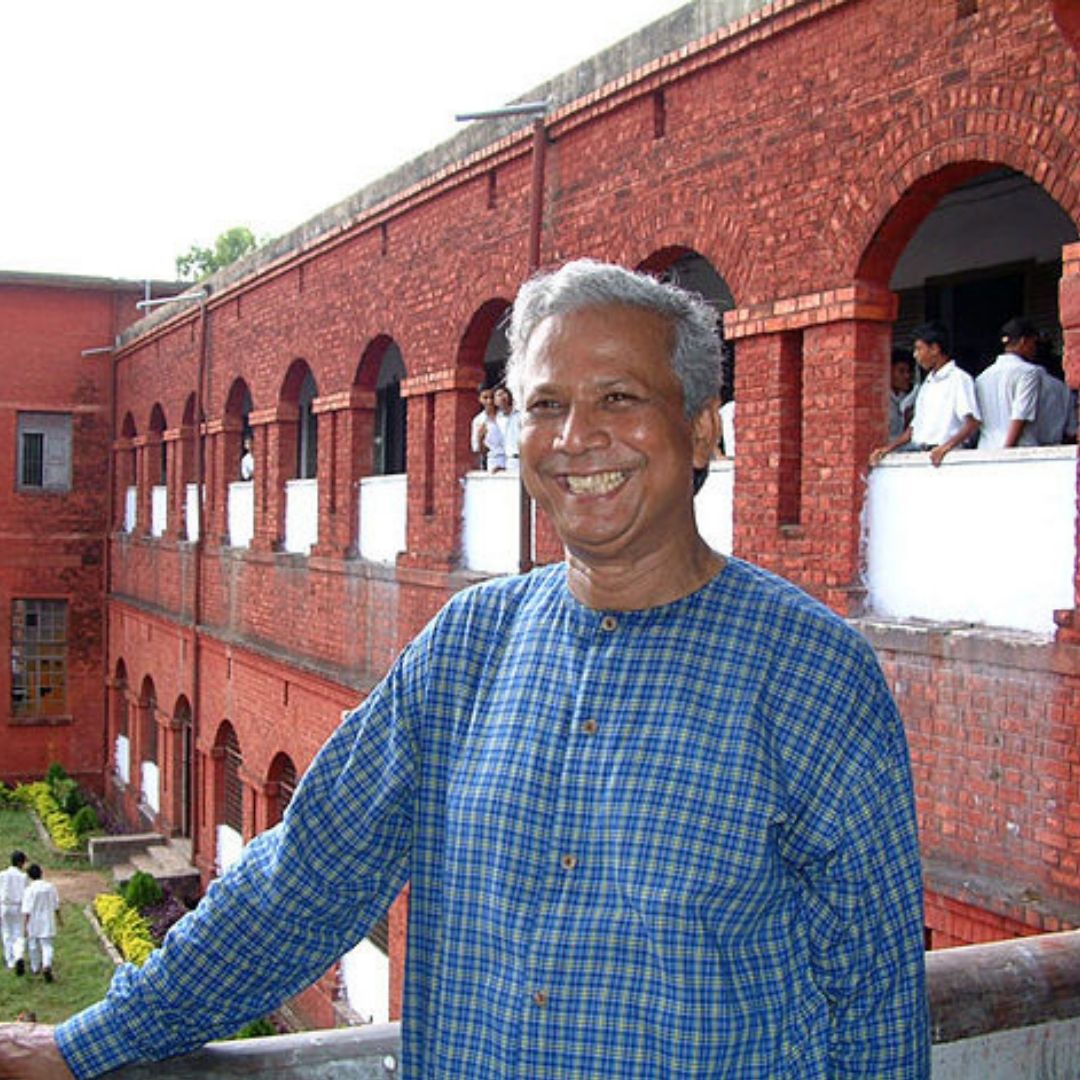

Image Credits: Wikimedia

Why Is Muhammad Yunus Known As The 'Father Of Micro-Finance'?

Writer: Akanksha Saxena

I am a budding journalist who loves to write stories that have the ability to connect with people.

Others/World, 5 April 2022 11:05 AM GMT

Editor : Snehadri Sarkar |

While he is a massive sports fanatic, his interest also lies in mainstream news and nitpicking trending and less talked about everyday issues.

Creatives : Akanksha Saxena

I am a budding journalist who loves to write stories that have the ability to connect with people.

Muhammad Yunus is a household name for Bangladeshis worldwide for his contribution to popularising the concept of 'micro-financing'- which empowered the rural community in his community and led him to win the Nobel Peace Prize.

Over the years, concepts such as micro-finance, small businesses, etc., have flourished. They are ways that make the global economy inclusive for the marginalised and the downtrodden in different parts of the world. In recent times, these methods are becoming popular, specifically in developing countries, becoming a vital source of livelihood for most people.

As capitalism continues to gain momentum in today's world, several modifications have emerged that have made the ideology accessible and inclusive. An example of this is what a man named Muhammad Yunus introduced. He is known as the "father of micro-finance", where he encouraged the rural community in Bangladesh to buy tiny loans to help run their businesses and uplift the women in this regard.

Introduced 'Micro-Credits' To The Poor

Muhammad Yunus graduated with a degree in Economics that he put to good use. In 1974, Bangladesh was ravaged by famine, during which Professor Yunus decided to lend a helping hand. He established a rural development programme to uplift the villagers by encouraging them to do small businesses that could help get their livelihood back on track.

1976 was an important year when Muhammad Yunus introduced micro-finance. He believed that small loans could make a big difference in their lives. He started to give micro-credit to villagers, which meant providing small loans to the marginalised communities without any extravagant collaterals. Therefore, he lent $27 from his pocket to around 42 women. With this, they started a bamboo basket business that brought about a lot of profits that helped them pay back the money.

Slowly and steadily, Yunus' initiative gained momentum, He could secure a loan from the government-owned Janata Bank. Come 1983, he began his labour of love called 'Grameen Bank.' As the name suggests, it was an establishment exclusively for the poor. The process involved forming informal "solidarity groups" where they apply for loans together. The fellow members act as the co-guarantors for repayment and an economic support system for each other.

Recipient Of Nobel Peace Prize

Muhammad Yunus' pilot project became a source of inspiration for many countries worldwide. Under the Grameen Foundation, several non-profit initiatives employed people from different sections of Bangladeshi society. Over the years, the micro-finance models found themselves replicated in over 100 nations, including the United States.

For his pathbreaking efforts, he received the Nobel Peace Prize in 2006. He also received many other prestigious awards for his work, such as the Ramon Magsaysay Award, Presidential Medal of Freedom, the International Simon Bolivar Prize, and many others. In 2012, his name was included in the 12 most outstanding entrepreneurs of the era.

Also Read: Looking Back At The Ills Of 'Apartheid' In South Africa Etched Forever In History

All section

All section